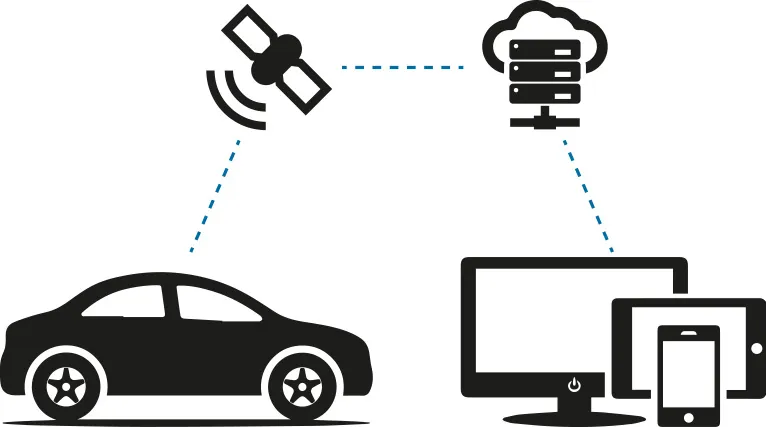

GESTION DE FLOTTES DE VÉHICULES, REGISTRE KILOMÉTRIQUE AUTOMATISÉ ET REPÉRAGE

Afin de maximiser le temps et la rentabilité de votre entreprise, ODOTRACK vous aide en produisant certains rapports de gestion. Que ce soit pour les avantages imposables, l’allocation kilométrique, les dépenses d’affaires, les dépenses d’emploi ou la gestion de la flotte de votre parc automobile, Odotrack s’occupe de tout.

VOUS ÊTES EN AFFAIRES ? ÇA VOUS CONCERNE.

demandez votre démo